Transfer-alpha: Value hiding in plain sight

Product Announcement

January 8, 2024

Josh Gelinas

|

Product Lead

Luminary’s value creation feature enables advisors to systematically track and report on asset growth outside of an estate, making tax savings from wealth transfer a tangible part of their client value proposition.

Delivering consistent, net-of-fee investment value added, or alpha, has never been easy. And for many high net worth clients whose financial security is already assured, it’s also not their most important issue. Connecting their assets with the people and causes they care about most is what motivates them. It’s also a source of economic value that can exceed even best-in-class investment alpha, but yet it almost always goes unreported.

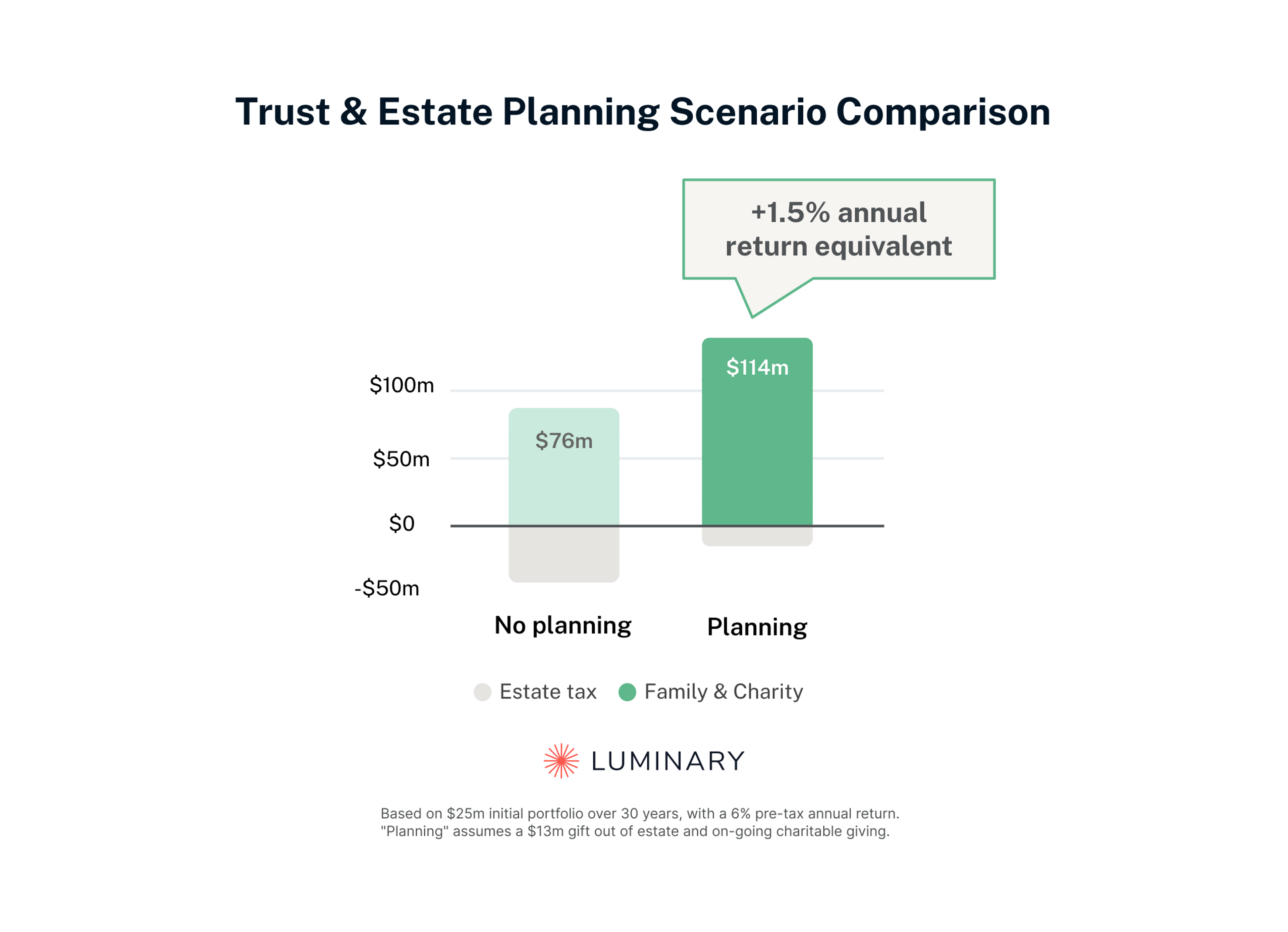

Trust & estate planning scenario comparison shows a 1.5% annual return equivalent over 30 years.

The reason for this is tracking growth of wealth transferred to family and philanthropy does not have a natural home in any existing technology stacks. Typically done in excel, the work required is time consuming and error-prone, so it often goes undone…and unnoticed. Until now.

What gets measured, gets valued

Luminary enables advisors to efficiently capture and systematically quantify the tax benefits of gifts and giving as part of their existing workflow.

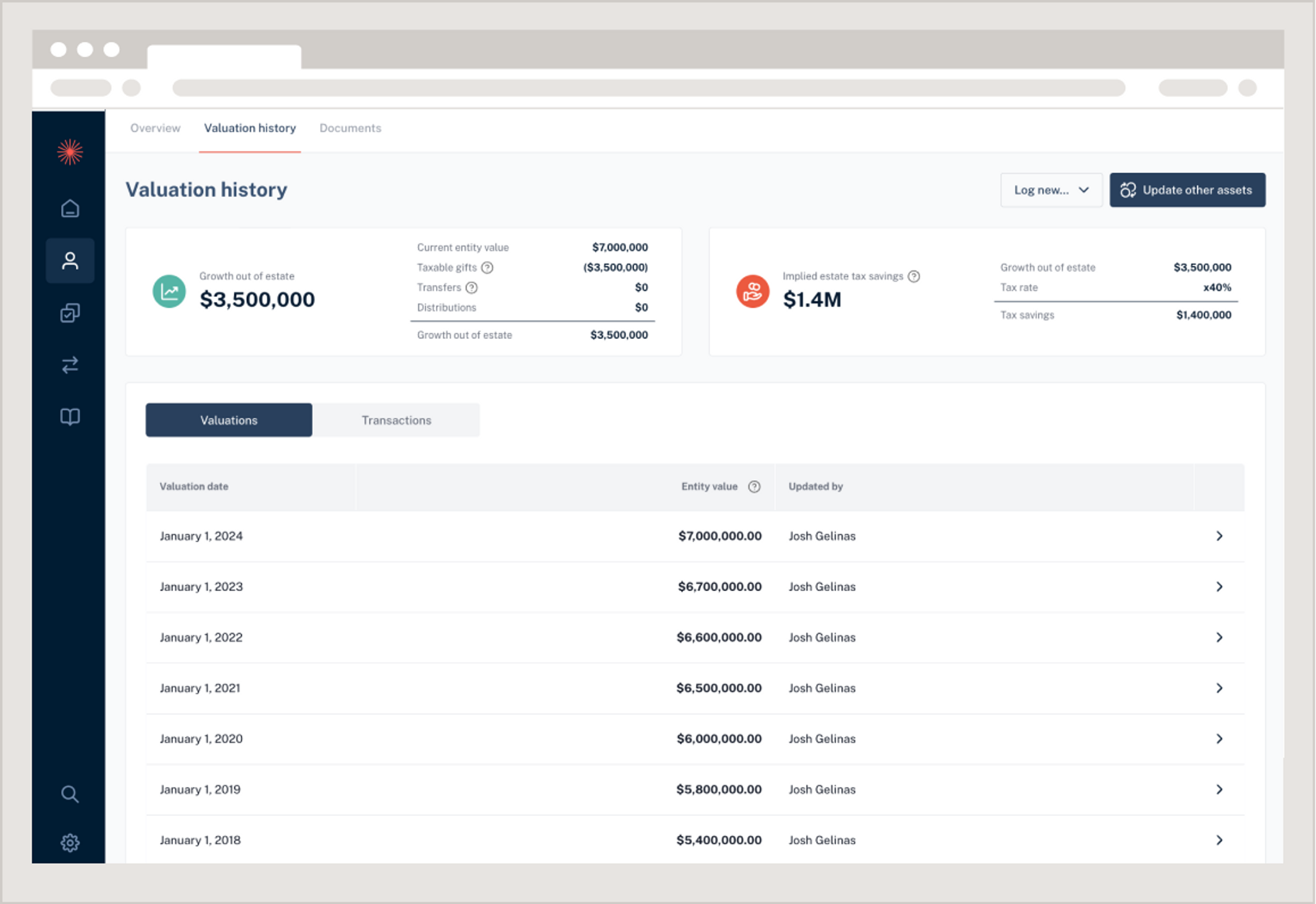

- Track information all in one place. Luminary’s digital entity records make valuation updates an auditable history of gifts, distributions, and transactions. This tracks and quantifies the value of asset growth outside of the estate, and associated tax savings.

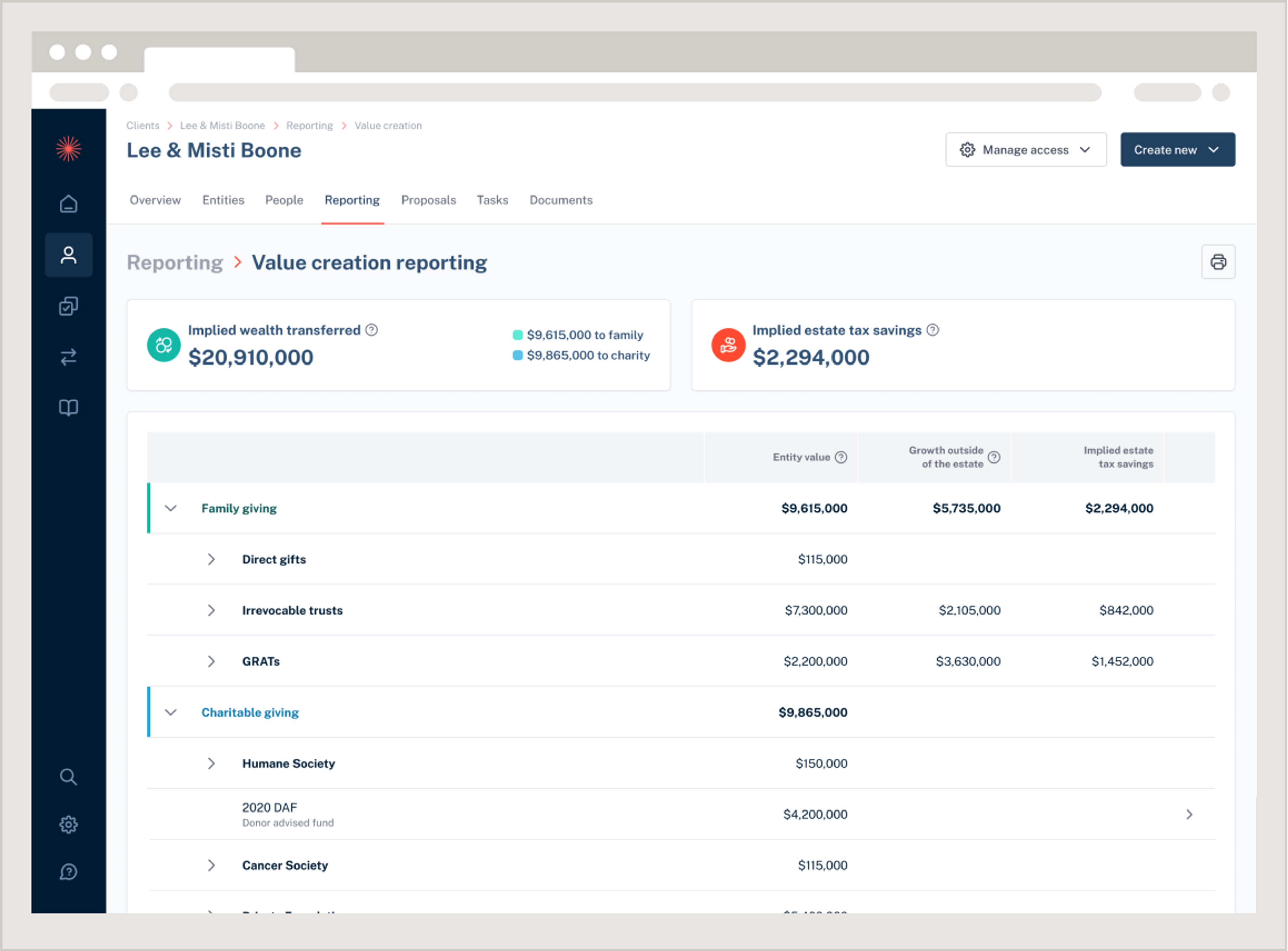

- Illuminate the value created by long-term strategies. Luminary’s value creation report makes it easy for advisors to clearly communicate how estate planning advice over time is helping connect their client’s assets with their legacy goals. This helps clients follow the economic value of their legacy, enhancing the emotional benefits.

- Add tax and transfer-alpha to your client value proposition. Luminary’s value creation report also adds another metric to typical investment review meetings. There’s no reason the value of planning advice should be left to the imagination when clients and prospects consider the return on the fees they pay.

Add a new dimension to your practice

Wealth advisors create value beyond investment returns, and can now demonstrate those benefits in a tangible way. Holistic planning is differentiating when competing for new business and, among existing clients, leads to deeper relationships across generations. Quantifying planning value leads to higher win rates, better retention, and greater share of wallet.

Luminary is technology transforming wealth transfer.

Luminary users can log in now to access the value creation dashboard and begin logging transactions, or set up a call with Luminary’s product team for a guided walk-through. Don’t yet have access to Luminary's estate planning software? Book a demo and learn more at withluminary.com/product